Vol. XXV, No. 7, July 2025

The food adventurer formula for LBE success

The term "foodie" has evolved significantly since its emergence in the early 1980s. Today, a foodie is broadly defined as a person with an enthusiastic interest in food, particularly exploring diverse culinary experiences, preparation methods, and food trends. Modern foodies are described as individuals who have an ardent or refined interest in food and alcoholic and non-alcoholic beverages and who seek new food experiences as a hobby rather than simply eating out of convenience or hunger. Unlike gourmets who focus on high-quality, expensive cuisine, foodies are characterized by their curiosity and willingness to explore food experiences across all price points, from street food to fine dining. They are interested in immersive food and drink experiences and the democratization of food culture through social media and digital platforms.

Foodies are drawn to various flavors and trends, including global and fusion cuisines, plant-based options, and adventurous flavor combinations. They also appreciate health-focused options, comfort foods elevated with global flavors or interesting combinations, and innovative condiment choices.

Today's foodies are passionate about culinary experiences and deeply invested in sustainability across multiple environmental, economic, and social dimensions.

The foodie phenomenon is exhibited by the explosion of specialized food programs and networks, including The Food Network, Hell's Kitchen, Top Chef, The Great British Baking Show, Someone Feed Phil, etc., and food-focused magazines and films.

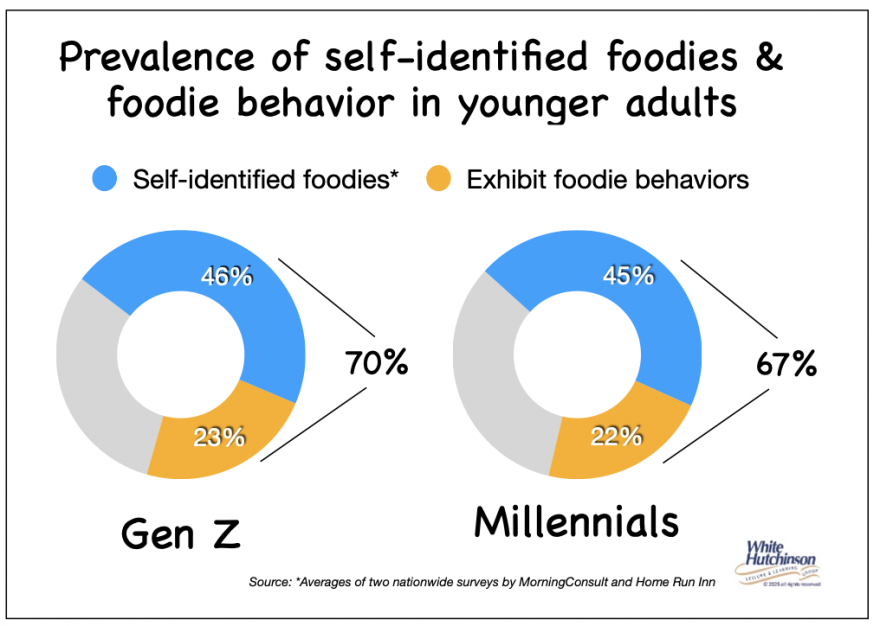

Adult Gen Z and Millennials (ages 18-44) have the highest proportion of self-identified foodies. Based on two recent surveys, between 43% and 49% of Gen Z self-identify as foodies. For Millennials, it's between 43% and 47%.

Many Gen Z and Millennials who engage in food exploration and culinary trends, foodie behavior, reject the foodie label. A 2022 YPulse study found that 46% of Gen Z indicated Millennial foodie culture is "cringy" due to its association with Instagram-worthy plating and identity signaling.

Many Gen Z and Millennials exhibit culinary exploration patterns aligned with foodie culture, such as frequent experimentation with global cuisines, adventurous dining habits, prioritization of novel experiences, and culinary creativity, but don't necessarily self-identify as foodies. For Gen Z, it's about 70%, roughly 50% more than self-identify. For Millennials, around two-thirds exhibit foodie behaviors, around 45% more than those who self-identify.

For adult Gen Z and Millennials combined (ages 18-44), about two-thirds have foodie behaviors of food adventurism, although not all identify as foodies. For this article, this larger group will be called "Food Adventurers."

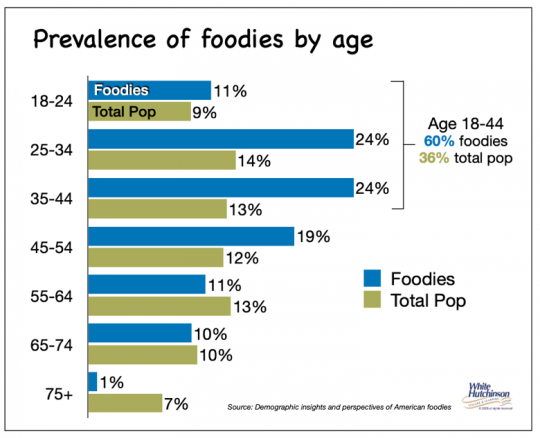

A 2021 survey of 1,117 Americans found that 18-44-year-olds amounted to 46.5% of self-identified foodies, with 57% of foodies holding a college degree compared with 48% of the total population. Other surveys have confirmed that foodies are predominantly characterized by higher educational attainment.

Food adventurism significantly influences Americans' decisions about attending an event or social gathering. A OnePoll survey found that:

- 62% of Americans would attend an event specifically for the food.

- 77% consider food important when attending public events.

- 74% would attend an event if they knew the food would be excellent.

- Food is the 2nd top consideration for people choosing which events to attend.

- 80% say they would return to an event that served good food.

The growing popularity of food festivals is further evidence of the appeal of food adventurism. Food festivals have evolved from niche culinary gatherings into significant cultural phenomena, with younger generations driving unprecedented growth in attendance and engagement. Millennials and Gen Z are the primary catalysts behind this surge.

In 2022, Eventbrite processed 13 million tickets for food and drink events nationwide, making it the third-largest category after music and business events. This demonstrates the substantial role that food adventurism plays in American entertainment and cultural participation. The growth trajectory suggests that food festivals are not merely recovering from recent challenges but are experiencing genuine expansion in popularity and participation.

A HelloFresh 2023 survey found that three in four Americans who have traveled in the previous five years say that more than anything else, they went for the food (74%). Travelers seek opportunities to immerse themselves in local cuisines, and food-related activities such as food festivals, cooking classes, and visits to farms or vineyards have become popular attractions. The growth of culinary tourism demonstrates the growing appeal of food adventurism.

According to American Express Travel's 2023 Global Travel Trends Report, food plays a pivotal role in travel experiences, with travelers often organizing vacations around culinary activities such as dining at acclaimed restaurants or participating in cooking classes. Approximately 81% of respondents prioritize exploring local foods and cuisines as the highlight of their travels.

The power of food and beverage offerings becomes even more pronounced in commercial entertainment venues. A 2023 stadium and concert venue research study found that 62% of consumers consider food options "very important" when selecting sports or concert venues. Among stadium visitors, 78% ordered food during their visits. Food and beverages have evolved from auxiliary amenities to fundamental drivers of consumer decisions regarding out-of-home entertainment venue selection. The data suggests consumers prioritize experiences that combine leisure with culinary satisfaction, increasingly viewing out-of-home leisure experiences holistically, where food offerings and quality contribute significantly to overall value perception.

Integrating food and beverage (F&B) offerings into entertainment venues has transitioned from a peripheral amenity to a central driver of consumer choice. Across sectors-including cinemas, sports stadiums, theme parks, location-based entertainment venues (LBEs), and corporate events-F&B quality, variety, and innovation now significantly influence attendance patterns, revenue generation, and long-term visitor loyalty. F&B is now one of the most potent tools for attracting and retaining attendees.

Entertainment venues need to recognize that treating food and beverage as an integral component of the overall experience, rather than as a basic concession service, gives them a sustainable competitive advantage.

The location-based entertainment industry (LBE) has evolved from its beginnings over three decades ago, with just concession food to venues incorporating food and beverage (F&B) as a significant component, called eatertainment. Venues like Dave & Buster's, Chuck E. Cheese, Main Event, and Peter Piper Pizza incorporate dedicated dining areas. A 2019 YouGov survey found that 62% of Americans often choose an eatertainment venue for a night out with friends.

Rather than having the entertainment and F&B as two distinct areas that are experienced sequentially, newer concepts, such as social gaming (inappropriately often called competitive socializing), have simultaneously woven food and beverage into the gaming experiences, with the F&B accounting for 50% or more of revenues. Topgolf and Flight Club are just two examples of many. Technomic found that three-quarters of consumers (76%) have a desire for venues offering more experiential dining entertainment options

Younger adults think of food and beverages as a conduit to socializing, a way to connect and spend time with others, and a way to explore and treat themselves. As a result, food and beverages have become increasingly important in attracting Gen Z and Millennials to LBEs, especially at social gaming venues.

Social gaming venues have F&B offerings, including selections targeting Food Adventurers rather than only the more common offerings at the older concept LBEs with dedicated dining areas. Neither Main Event nor Dave & Buster's has any innovative global-fusion offerings other than a few with a Mexican influence. Peter Piper Pizza lacks any global-fusion options.

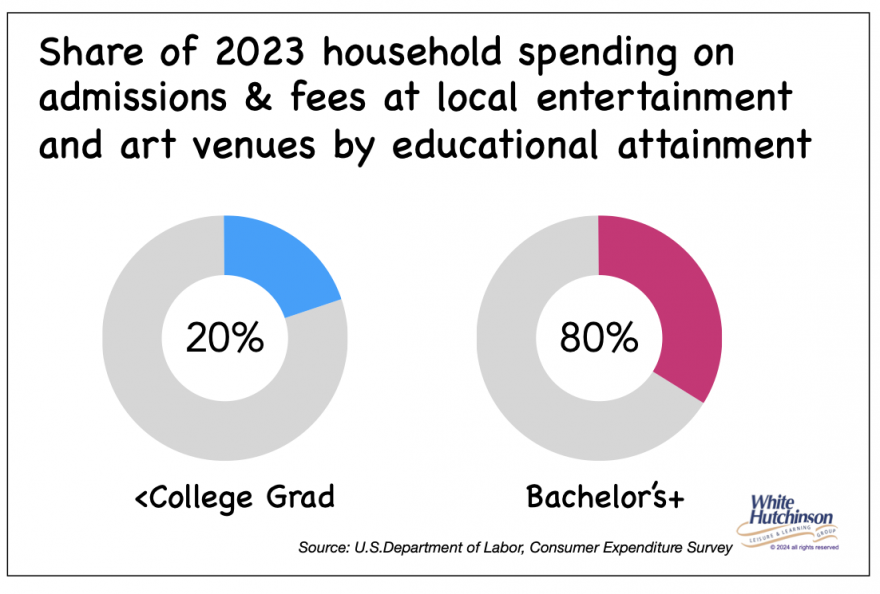

Adult Gen Z and Millennials (ages 18-44), younger adults, are the primary target market for most community LBEs. Two out of three are Food Adventurers. Since attendees at LBEs are highly skewed college-educated (80%), as are young adult Food Adventurers, probably more than three-quarters of LBE attendees are Food Adventurers.

The higher educational attainment and resulting higher income profile of Food Adventurers enable them to prioritize quality over cost considerations. Unlike lower-income consumers who must focus primarily on price and value when making food purchases, most foodies possess the economic flexibility to invest in quality F&B selections.

An LBE's food and beverage offerings can easily make or break its success. Not only can the F&B determine whether younger adults choose to attend initially, but it can also determine repeat visitation. One thing that F&B appealing to Food Adventurers can do is overcome the decline in repeat appeal, been there, done that, by offering novelty-seeking young adults new and different F&B experiences with a good menu variety of appealing F&B offerings as well as appealing LTOs (limited-time offerings) that invite novelty-seeking Foodie Practitioners to return. Food Adventurers are especially interested in new F&B experiences.

When F&B appealing to Food Adventurers is holistically combined with social games, it raises the quality of the social experience, making it a winning formula with more appeal to young adults than most older-style LBEs or just visiting a restaurant. This is why social gaming venues are a rapidly growing segment of the LBE industry.

Subscribe to monthly Leisure eNewsletter